when to expect unemployment tax break refund california

How The Tax Break Works. Refunds should be hitting mail boxes and bank accounts however you normally.

1 Million Californians Owed Bigger Tax Refunds Abc10 Com

We expect about 95 of all MCTR payments direct deposit and debit cards combined to be issued by the.

. Keep any notices you receive for your records and make. The tax break isnt available to those who earned 150000 or more. The federal tax code counts jobless.

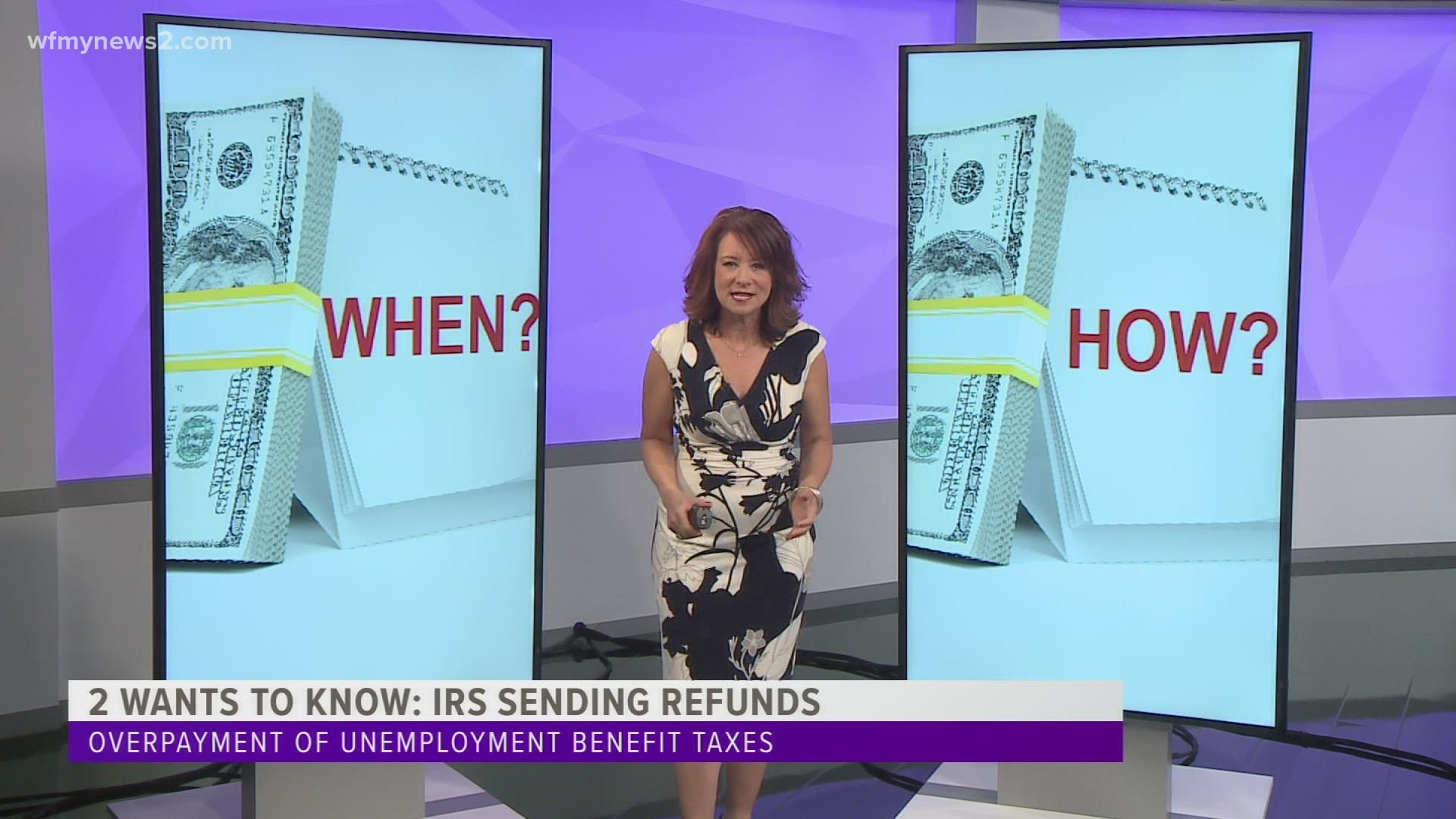

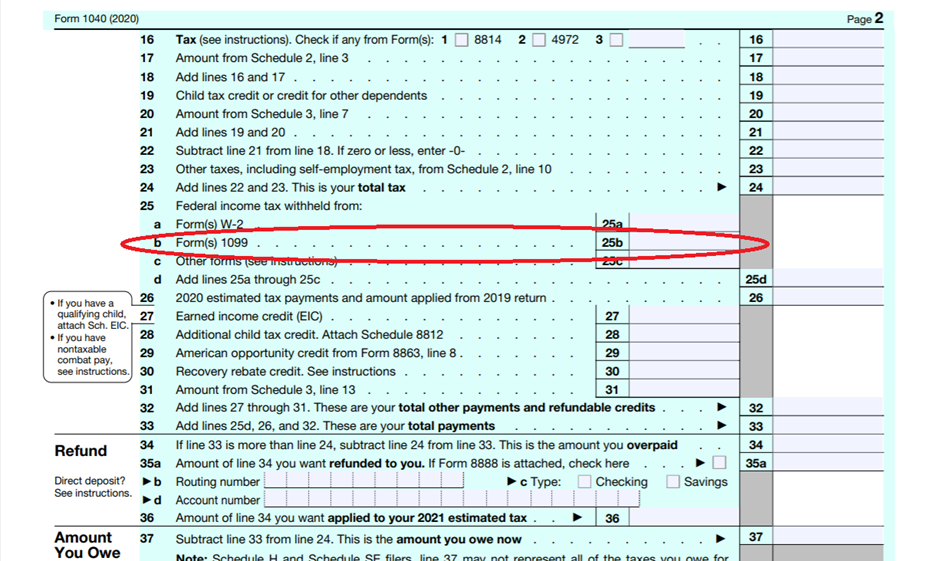

Irs unemployment refund irs unemployment tax refund irs unemployment tax refunds unemployment tax break refund unemployment tax refund. Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor Claimants can expect to receive payments 30 60 days after their application. If you claimed unemployment last year but filed your taxes before the new 10200 unemployment tax break was announced the IRS says you can expect an automatic refund.

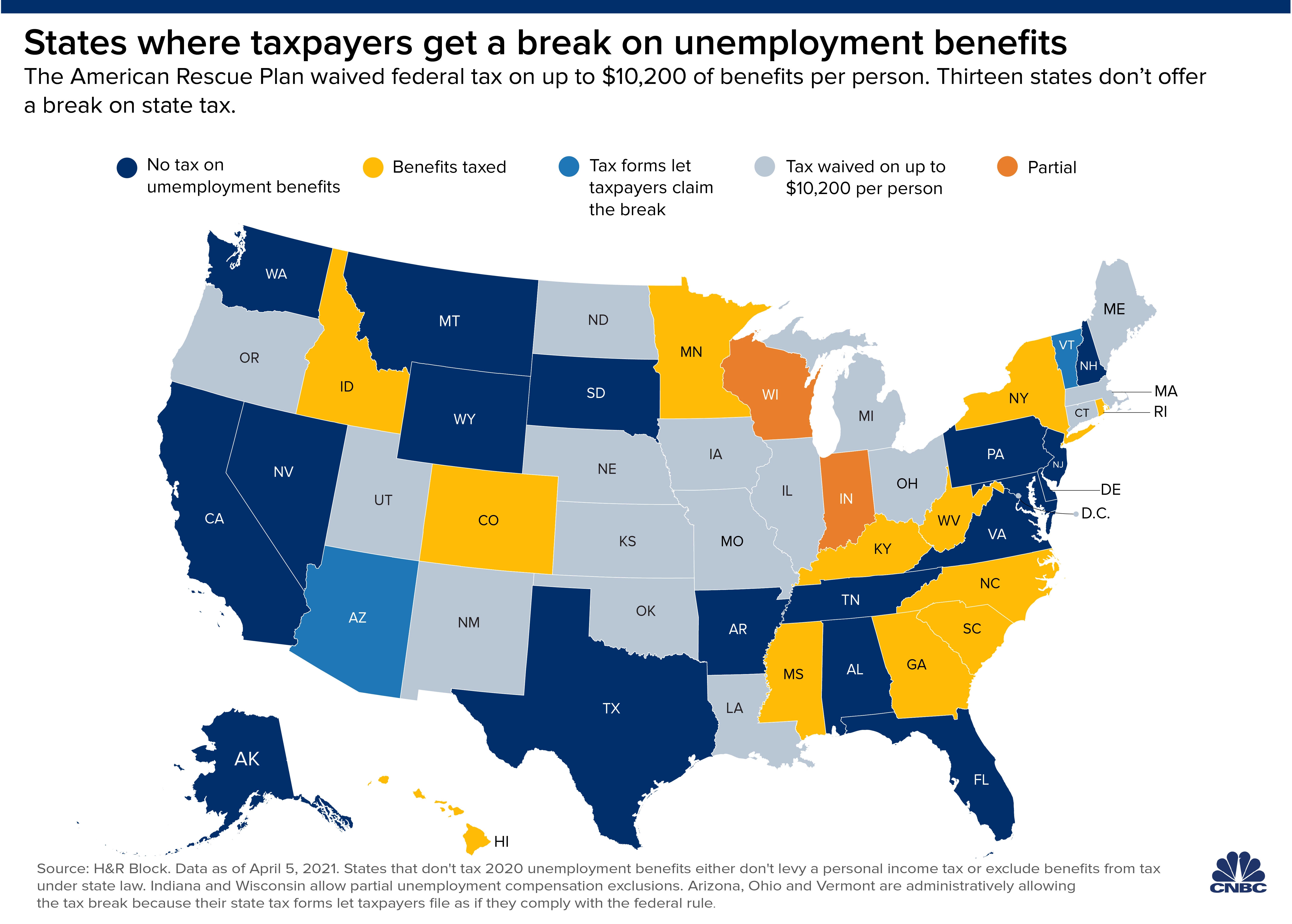

If you claimed unemployment last year but filed your taxes before the new 10200 unemployment tax break was announced the IRS says you can expect an automatic refund. When it went into effect on March 11 2021 the American Rescue Plan Act ARPA gave a tax break on up to 10200 in unemployment benefits. Four million Americans will receive their unemployment tax refunds this week Credit.

Now the good news is that last year the IRS paid tax filers interest on refunds issued after the original April 15 tax-filing deadline. The tax break is for those who earned less than 150000 in adjusted gross income and for unemployment insurance received during 2020. Tax break for Unemployment.

When to expect a refund for your 10200 unemployment tax break. As part of COVID relief legislation federal taxes for individual filers can be waived for up to 10200 in unemployment income for the 2020 tax. We expect about 90 of direct deposits to be issued in October 2022.

A tax break isnt available on 2021 unemployment benefits unlike aid collected the prior year. We will make the changes for you. Theres a chance the agency will do the same this.

Its currently 750 until early september. The IRS will begin in May to send tax refunds in two waves to those who benefited from the 10200 unemployment tax break for claims in 2020. The IRS will send you a notice explaining any corrections.

If you claimed unemployment last year but filed your taxes before the new 10200 unemployment tax break was announced the IRS says you can expect an automatic refund. Meanwhile households who are receiving the cash refund by paper check can expect. Expect the notice within 30 days of when the correction is made.

The American Rescue Plan waives federal tax on up to 10200 of unemployment benefits per person in 2020. When To Expect A Refund For Your 10200 Unemployment Tax Break If you claimed unemployment last year but filed your taxes before the new 10200 unemployment. Dont expect a refund for unemployment benefits.

Filed or will file your 2020 tax return after March 11 2021 and. If you qualify for a bigger tax refund youll receive it beginning August 2021. If you claimed unemployment last year but filed your taxes before the new 10200 unemployment tax break was announced the IRS says you can expect an automatic refund.

At this stage unemployment.

Fourth Stimulus Check Live Updates New Payment In California Unemployment Benefits Child Tax Credit As Usa

Where S My Refund California H R Block

Irs Refund 4 Million Tax Refunds For Unemployment Compensation Marca

Tax Refund Whiplash Pandemic Perks Give Some A Windfall Others A Bill Politico

Unemployment Tax Refund Update What Is Irs Treas 310 Abc10 Com

Is Unemployment Taxed H R Block

I R S Will Automatically Refund Taxpayers Eligible For Unemployment Credit The New York Times

Unemployment Benefits Are Not Tax Free In 2021 So Far

Do I Have To Pay Taxes On My Unemployment Benefits Get It Back

Tax Season Is Here Don T Expect A Refund For Unemployment Benefits

430 000 People To Receive Surprise Tax Refund From Irs

States Seek Amended Tax Returns For 10 200 Unemployment Tax Refunds

When To Expect Your Unemployment Tax Break Refund

Did You Get Michigan Unemployment Benefits In 2021 Don T File Your Taxes Yet Mlive Com

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

Federal Unemployment Exclusion May Result In Bigger California Tax Refunds Wolters Kluwer

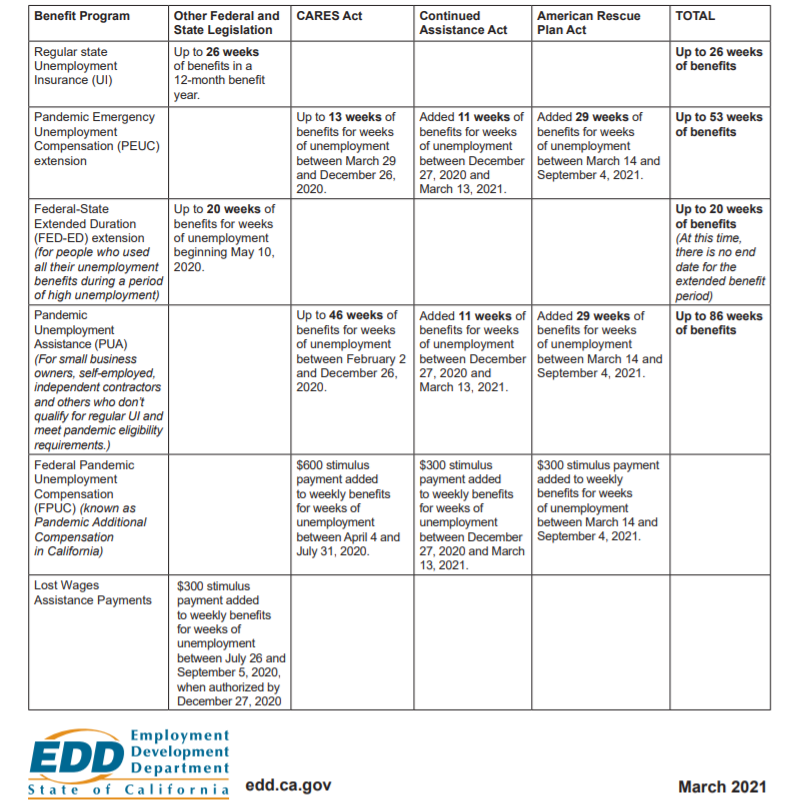

California Ca Edd Unemployment Benefits Ended For Pua Peuc And 300 Weekly Boost Pandemic Programs Update On Payment Issues Retroactive And Delayed Claims Aving To Invest